Holiday Round-Up: The Future of CRE, Thinking Machines, and the Experience Economy

004: Week of Dec 30, 2024 – Year-End Reflections and a Happy New Year!

As we close out 2024 and gear up for the new year, I’m thrilled to bring you this year’s final edition of Wellre—your go-to source for insights, ideas, and conversations about the wellness trends and spaces shaping our world. If this is your first time here, welcome! I’m so glad you’ve found your way to this corner of the internet.

Today, we’re diving into a packed edition to close out the year:

1. OpenAI’s o3 Models – The evolution of AI and what it means for commercial real estate and beyond.

2. Commercial Real Estate Outlook – Fear is fading, and investors are cautiously optimistic about the future of CRE.

3. Retail and the Experience Economy – How 2024 set the stage for a consumer shift toward connection and experiences.

4. Year-End Review (Self-Audit) – A quick framework to reflect on your wins and lessons from 2024.

5. Deals & Quick Hits – The most impactful headlines of the year, all in one place.

Let’s jump into it, and here’s to an insightful and prosperous 2025!

1. OpenAI’s Latest Breakthrough: The o3 Models

If you’re a fan of HBO’s Dune: Prophecy, you might recognize this ominous phrase: “Thinking Machines are forbidden.” In the Dune universe, these machines enslaved humanity, sparking a rebellion and a subsequent ban on artificial intelligence.

Fast forward to reality: OpenAI recently announced the release of its new o3 reasoning models—the successor to the o1 models (yes, they skipped o2 because the name is trademarked by British telecom company O2).

So, why all the buzz?

The o1 models introduced basic reasoning capabilities, but the o3 models will bring us closer to a frontier many have only imagined: Artificial General Intelligence (AGI). Unlike narrow AI, which excels at specific tasks, AGI matches or surpasses human cognitive abilities across a broad range of tasks.

While we’re not quite there yet, o3 marks a huge leap forward. It achieved what many thought was impossible, scoring 87.5% on the ARC-AGI benchmark, a test designed to measure human-level intelligence.

For context:

• The human benchmark stands at 85%.

• ChatGPT-4 (the most recent model) scored just 5% on this test.

Many believed we’d reached the peak of AI innovation, but o3 proves we’re just getting started. This is the next wave of artificial intelligence.

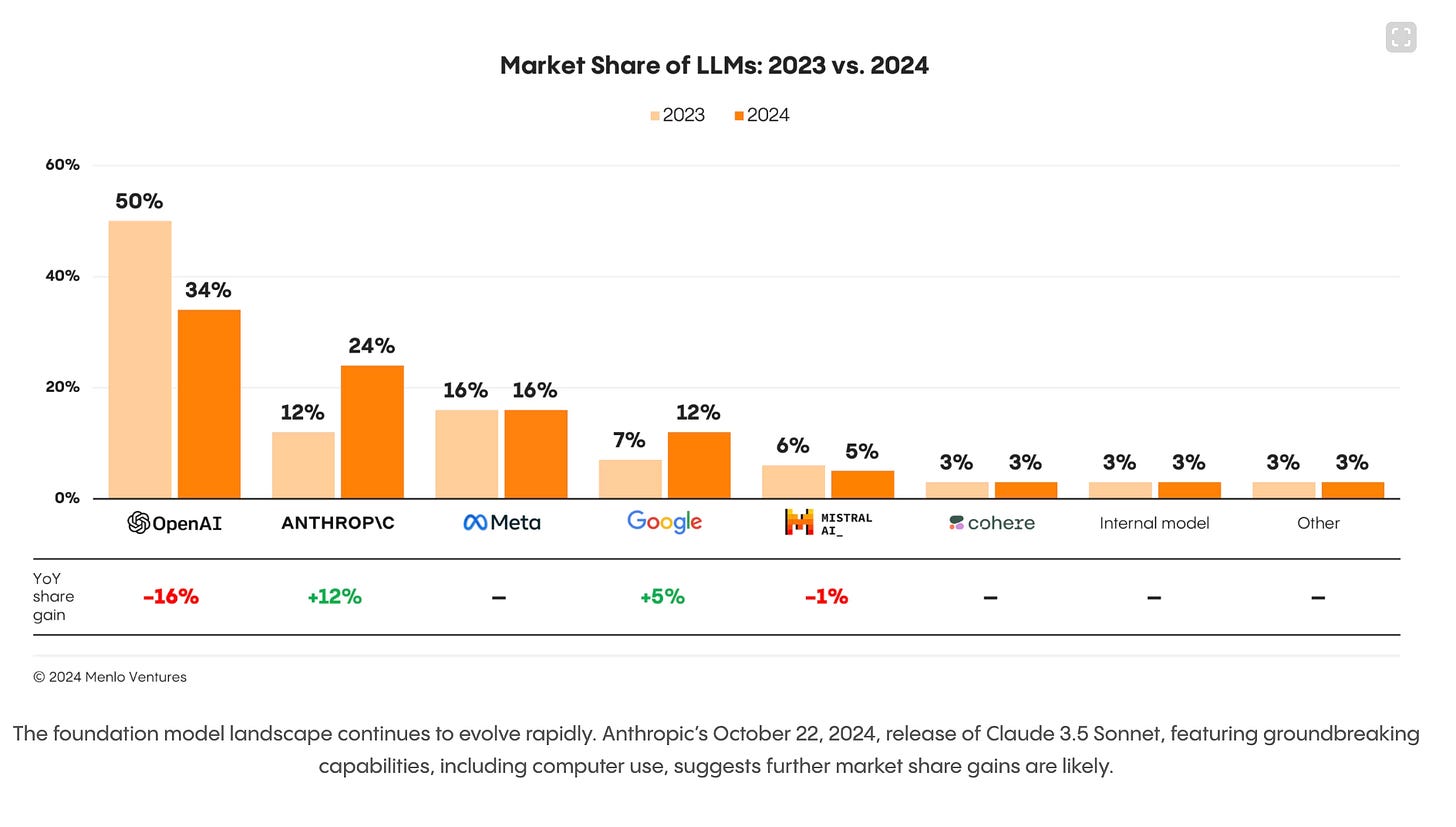

While OpenAI currently leads the pack, its dominance is being challenged as innovation spreads throughout the ecosystem.

Market share dynamics are shifting. OpenAI’s enterprise market share dropped from 50% in 2023 to 34% in 2024. Anthropic doubled its market share since last year, and Google’s market share is up 71%.

These numbers illustrate a rapidly evolving landscape where competition is fierce, and the pace of innovation shows no signs of slowing.

Bottom Line

AGI’s potential impact on the commercial real estate industry is staggering. Think about it: predictive analytics that can outpace human intuition, tenant experiences that feel custom-tailored, and properties designed with the flexibility to evolve alongside market needs.

For CRE, AGI could mean smarter investment strategies, more efficient property management, and faster, better decision-making across the board.

Of course, it’s not all smooth sailing. Ethical dilemmas, workforce shifts, and regulatory challenges will demand our attention.

As we inch closer to this new frontier, the big question isn’t just what AGI will do—but how we’ll choose to wield its power. Are you ready for what’s coming?

2. Fear Is Fading: CRE Investors Signal Optimism

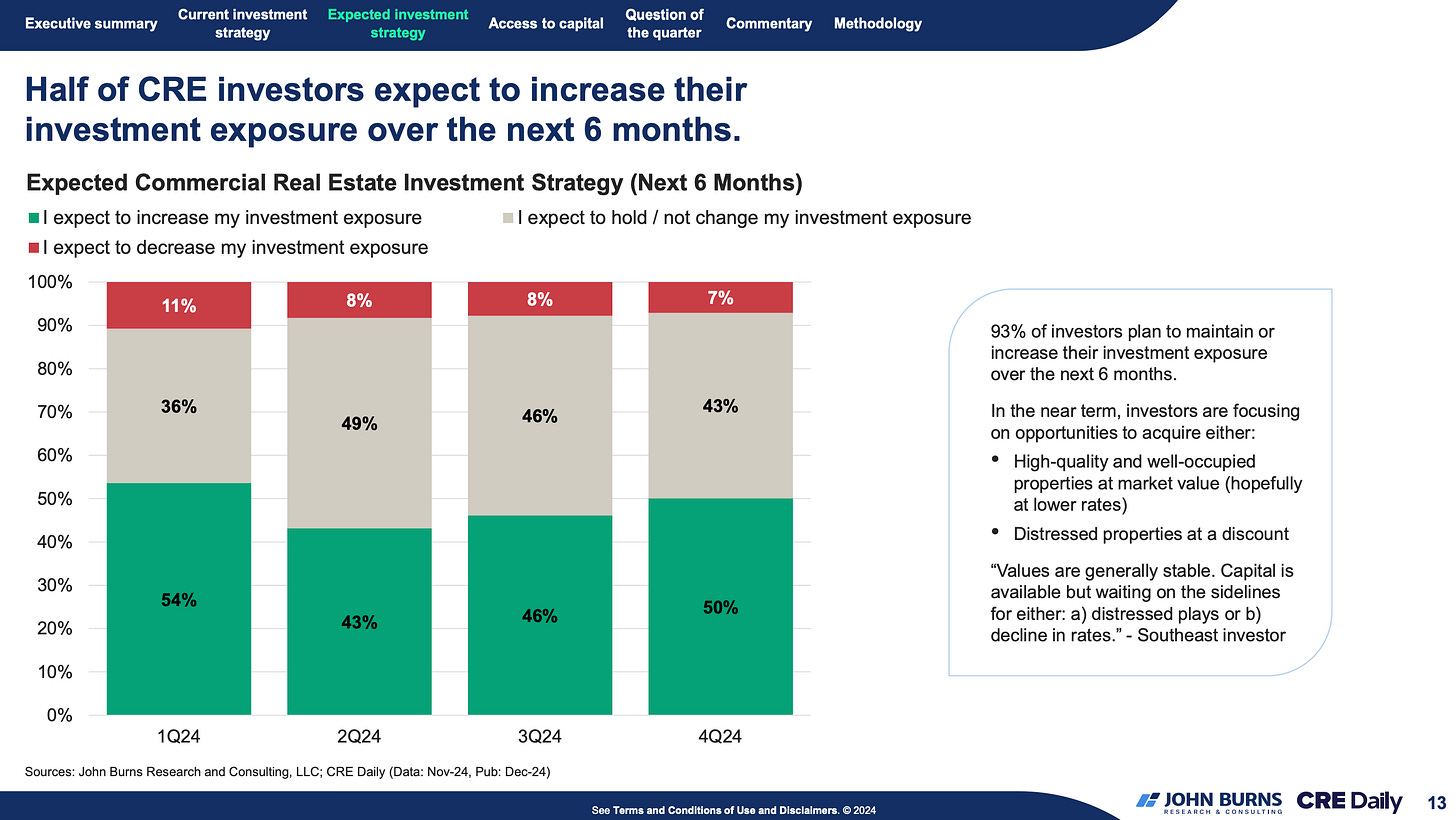

Is the commercial real estate market bouncing back? The latest Fear and Greed Index suggests so, with an overall score of 56—marking “expansion” territory. This optimism comes as 93% of investors plan to maintain or increase their exposure in the next six months.

But what exactly is the Fear and Greed Index? Think of it as a barometer for investor sentiment. Scores above 55 signal expansion (“greed”), while below 45 indicates contraction (“fear”). While the numbers suggest a positive trend, the real story lies in the details:

Investment Strategies at a Glance

• Growing Confidence: 25% of investors are increasing exposure—the highest in over a year.

• Playing It Safe: 65% are in a holding pattern, waiting for clearer market signals.

• Sector Favorites: Multifamily, industrial, and retail top the list for growth, while the office sector struggles to keep up.

Sector Highlights: Winners and Losers

• Office: Facing headwinds (-15% YOY value drop), high-interest rates (6.6%), and remote work shifts. Investors are pulling back, with many reducing their exposure further.

•Multifamily & Retail: Steady investor interest. Retail values even rose YOY, a bright spot in the market.

• Industrial: With strong fundamentals, industrial real estate is poised for asset value increases in the months ahead.

Navigating the Debt Challenge

• Average Rates: CRE loans hover around 6%, with office loans reaching 6.6%.

• Maturing Loans: A significant share of CRE loans (18% to 24%) will mature by 2025, forcing investors to refinance at today’s higher rates.

• Investor Strategies: Investors are exploring options like bridge financing, asset sales, and capital injections to manage new debt obligations.

Opportunities on the Horizon

• Distressed Assets: Investors are eyeing discounted opportunities in distressed assets, particularly high-quality properties with stable occupancy.

• Capital on Standby: There’s plenty of capital available, but much of it is sitting on the sidelines, waiting for the right deals.

• Long-Term Outlook: While the market shows resilience, recovery remains uneven across sectors. Factors like interest rates and potential policy shifts, including new tariffs, continue to weigh on decision-making.

Key Takeaway:

The commercial real estate market is inching toward recovery, with growing confidence in multifamily, industrial, and retail sectors. However, the debt landscape and the persistent struggles of the office sector highlight the need for careful navigation. How are you positioning your portfolio for what’s next?

3. Redefining Retail: The Experience Economy

From brand collaborations and pop-up events to run clubs and group workouts, 2024 was the year of social wellness. According to Strava’s “Annual Year in Sport Trend Report,” global participation in running clubs surged by 59% this year. Surprisingly, 4x more people prefer meeting new friends through fitness groups than bars, and 1 in 5 Gen Z respondents even went on a date with someone they met at a fitness activity.

Gen Z is redefining how we connect. Instead of bars or nightclubs, they’re turning to third spaces like run clubs or fitness groups to meet like-minded people and build meaningful communities. The data is clear: nightclubs are out, and social wellness clubs are in.

But why does this matter?

As eCommerce continues to dominate, retailers must find ways to stand out. Collaborations like the one between Nike Run Club and La Marzocco are doing just that. These events offer brands a unique opportunity to connect with consumers in a way that feels organic, low-pressure, and fun. The payoff? Increased brand awareness, credibility, and loyalty.

Take the example of Nike Run Club’s November 2024 event in Istanbul. They organized the first-ever race through the Grand Bazaar since 1455, attracting over 700 participants. The event, held in collaboration with La Marzocco, created buzz across social media and brought attention to the local community, all without feeling “salesy.”

Urban Retail Is Thriving

Urban retail is having a moment, and brands like ALD (Aimé Leon Dore) are proof.

I saw this firsthand during some last-minute Christmas shopping. Despite the freezing 20° weather, ALD’s New York City flagship store was packed when I arrived around 4:30 PM on Sunday. With the store closing at 6 PM and a two-hour waitlist already full, they weren’t letting anyone else in. Clearly, they’re showing no signs of slowing down.

If you’re unfamiliar, ALD is a NYC-based fashion brand founded in 2014 by Teddy Santis. You might not know his name, but you’ve likely seen his influence through collaborations with New Balance, Porsche, or Rimowa. ALD’s ability to create buzz and build cultural influence is unparalleled.

According to JLL’s recent City Retail Report, luxury brands are doubling down on long-term real estate investments. Opportunistic HNWIs and private capital investors are snapping up prime urban corridors while the “window is still open.” Trends like the return to office, a near-full recovery of international travel, and strong retailer performance are fueling this demand.

The Experience Economy Is Here

We are knee-deep in the experience economy. Shopping isn’t just about buying things anymore—it’s about being seen, connecting with others, and soaking in the vibe. It’s hitting Café Leon Dore for a coffee, browsing the flagship store, and capping it off with dinner and drinks at Rubirosa (or Torrisi, if you’re lucky enough to snag a reservation).

Retail today is all about creating memorable, meaningful experiences. Brands like ALD get this. They’ve mastered the art of blending collaborations, pop-up events, and community-driven initiatives to build buzz and loyalty. Their New Balance collab, for example, is credited with reviving the iconic sneaker brand—transforming it from your dad’s Saturday morning chore shoe to a staple on the runway.

Make no mistake: urban retail is thriving. The brands that lean into this new reality—focusing on connection, community, and unforgettable experiences—will lead the way in the years ahead.

4. Year-End Reflection:

Two things I’m prioritizing heading into 2025 are sleep and diet. My eating habits are usually pretty clean, but let’s be real—the holiday season hit hard this year. To reset, I’m kicking off January with the 30-day Whole30 challenge.

If you’re not familiar, Whole30 is an elimination diet, not a weight-loss diet. The goal? Cut out dairy, grains, legumes, added sugars, and processed foods for 30 days to reduce inflammation in your gut and body. People rave about having more energy, mental clarity, less brain fog, and finally kicking those cravings. I’ll report back on my progress next week.

What if you don’t know where to start?

If you’re unsure where to start with your self-audit, I like to break my goals into two main categories—Professional and Personal—and then further into subcategories. For example, I divide each into short-term and long-term targets, track progress, and get as detailed as possible.

For Professional goals, short-term might include current work projects or 6-12-month milestones. Long-term, on the other hand, is about the big picture: 3-5 years out, future career goals, and even what life looks like 20 years from now. What steps am I taking today to get there?

For Personal goals, I focus on areas like fitness, health, races or events, finances, and relationships—you get the gist. The key is to map out what matters most and create actionable steps to get closer to those goals.

And if you’re still stuck, start with inspiration. Who do you look up to? Who’s living the life you aspire to? What does your perfect day look like? Find someone living the way you want to live and start behaving the way they would. Model the mindset and habits that align with that vision, and you’ll be surprised how quickly things start to fall into place.

Here are a few simple but impactful ways to reflect, reset, and get ready for 2025:

• Brain Dump: Take a moment to reflect on the year. What were your highs, lows, wins, and challenges? Get it all out on paper.

• Course Correct: Look at your habits. What’s working, and what needs a tweak? Be honest about where you can improve and what changes you need to make.

• Get Excited: Put something on the calendar you’re genuinely excited about. A trip, a race, a big event—whatever lights you up. And most importantly, commit.

• Write it Down: Write out your goals. Don’t skip this step! You’re 42% more likely to achieve your goals just by writing them down.

I hope this inspires you to take stock of your own habits and set yourself up for an amazing 2025. I’d love to hear your thoughts, habits, or personal reflections in the comments—let’s keep the conversation going!

5. Quick Hits: The Top 10 Deals of 2024

1. Databricks raises $8.6B, nabbing crown from OpenAI for 2024’s largest VC round

2. PureGym finalizes Blink Fitness acquisition, expanding U.S. footprint

3. Ōura raises $200M as valuation jumps to $5.2B

4. Orangetheory merges with Anytime Fitness to create a global wellness giant

5. Marriott acquires Postcard Cabins (FKA Getaway) to launch outdoors-focused brand

6. Vuori raises $825M, hitting $5.5B valuation

7. Flo Health secures $200M in funding, reaching unicorn status

8. Hostaway raises $365M at a $925M valuation as travel rebounds

9. Equinox secures $1.8 B to refinance loans and support growth

10. Saks completes $2.7B Neiman Marcus acquisition, names new leadership

Quote of the Day

“The journey of a thousand miles begins with one step.”

- Lao Tzu